Does Wisconsin Tax Income From Other States . All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. Property taxes (imposed at the state level. seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said. • the income which is taxable by the other state is also considered income for wisconsin tax purposes. 52 rows state taxes can include: If you make $70,000 a year living in wisconsin you will be taxed $10,401.

from urbanmilwaukee.com

• the income which is taxable by the other state is also considered income for wisconsin tax purposes. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. 52 rows state taxes can include: Property taxes (imposed at the state level. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. If you make $70,000 a year living in wisconsin you will be taxed $10,401. seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said.

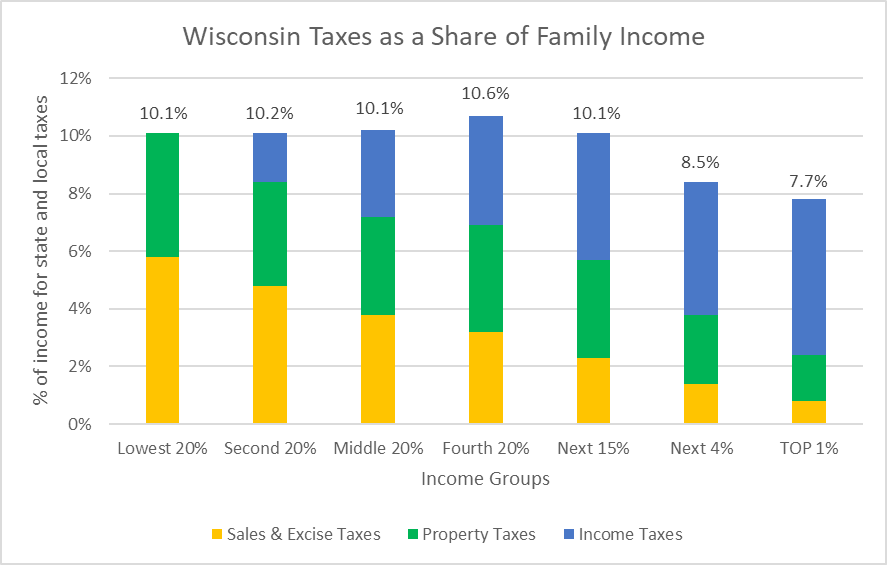

Data Wonk Should Wisconsin Adopt a Flat Tax? » Urban Milwaukee

Does Wisconsin Tax Income From Other States • the income which is taxable by the other state is also considered income for wisconsin tax purposes. Property taxes (imposed at the state level. • the income which is taxable by the other state is also considered income for wisconsin tax purposes. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. 52 rows state taxes can include: If you make $70,000 a year living in wisconsin you will be taxed $10,401. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said.

From usafacts.org

Which states have the highest and lowest tax? USAFacts Does Wisconsin Tax Income From Other States All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said. wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. the credit for taxes paid. Does Wisconsin Tax Income From Other States.

From www.stsw.com

How State Taxes Are Paid Matters Stevens and Sweet Financial Does Wisconsin Tax Income From Other States the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. • the income which is taxable by the other state is also considered income for wisconsin tax purposes. Property taxes (imposed at the state level. wisconsin individual income tax rates vary from 3.50% to 7.65%,. Does Wisconsin Tax Income From Other States.

From brokeasshome.com

Wisconsin Tax Tables Does Wisconsin Tax Income From Other States the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. • the income which is taxable by the other state is also considered income for wisconsin tax purposes. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. . Does Wisconsin Tax Income From Other States.

From urbanmilwaukee.com

Wisconsin Budget Rich Pay the Least in State Taxes » Urban Milwaukee Does Wisconsin Tax Income From Other States • the income which is taxable by the other state is also considered income for wisconsin tax purposes. If you make $70,000 a year living in wisconsin you will be taxed $10,401. wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. the credit for taxes paid to another state is. Does Wisconsin Tax Income From Other States.

From urbanmilwaukee.com

Data Wonk Should Wisconsin Adopt a Flat Tax? » Urban Milwaukee Does Wisconsin Tax Income From Other States Property taxes (imposed at the state level. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. • the income which is taxable by the other state is also considered income for wisconsin tax purposes.. Does Wisconsin Tax Income From Other States.

From biztimes.com

Wisconsin gets middle of the pack ranking for state business tax climate Does Wisconsin Tax Income From Other States seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said. Property taxes (imposed at the state level. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. • the income which is taxable by the other state is also considered income for. Does Wisconsin Tax Income From Other States.

From www.businessinsider.com

State tax rate rankings by state Business Insider Does Wisconsin Tax Income From Other States seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said. 52 rows state taxes can include: • the income which is taxable by the other state is also considered income for wisconsin tax purposes. wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital. Does Wisconsin Tax Income From Other States.

From www.richardcyoung.com

How High are Tax Rates in Your State? Does Wisconsin Tax Income From Other States the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. • the income which is taxable by the other state is also considered income for wisconsin tax purposes. 52 rows state taxes can include: seven states levy no income tax, while some others tax. Does Wisconsin Tax Income From Other States.

From reforminggovernment.org

Wisconsin Should Eliminate the State Tax Institute for Does Wisconsin Tax Income From Other States • the income which is taxable by the other state is also considered income for wisconsin tax purposes. If you make $70,000 a year living in wisconsin you will be taxed $10,401. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. Property taxes (imposed at. Does Wisconsin Tax Income From Other States.

From taxfoundation.org

Wisconsin Governor's Budget Tax Credits, Tax Increases Does Wisconsin Tax Income From Other States wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. Property taxes (imposed at the state level. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. seven states levy no income tax, while some others tax only capital. Does Wisconsin Tax Income From Other States.

From taxfoundation.org

State Tax Reliance Individual Taxes Tax Foundation Does Wisconsin Tax Income From Other States Property taxes (imposed at the state level. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. If you make $70,000 a year living in wisconsin you will be taxed. Does Wisconsin Tax Income From Other States.

From littlepostdesign.blogspot.com

littlepostdesign What Is The Tax Rate In Wisconsin Does Wisconsin Tax Income From Other States Property taxes (imposed at the state level. seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. If you make $70,000 a year living in wisconsin you. Does Wisconsin Tax Income From Other States.

From dl-uk.apowersoft.com

Wisconsin State Tax Forms Printable Does Wisconsin Tax Income From Other States wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. 52 rows. Does Wisconsin Tax Income From Other States.

From taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation Does Wisconsin Tax Income From Other States 52 rows state taxes can include: • the income which is taxable by the other state is also considered income for wisconsin tax purposes. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is earned. the credit for taxes paid to another state is automatically calculated in your account when you. Does Wisconsin Tax Income From Other States.

From brokeasshome.com

wisconsin tax tables Does Wisconsin Tax Income From Other States the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. If you make $70,000 a year living in wisconsin you will be taxed $10,401. wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. 52 rows state taxes can. Does Wisconsin Tax Income From Other States.

From www.signnow.com

Wisconsin Tax 1 20202024 Form Fill Out and Sign Printable PDF Does Wisconsin Tax Income From Other States wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. Property taxes (imposed at the state level. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. 52 rows state taxes can include: All income received by a wisconsin. Does Wisconsin Tax Income From Other States.

From taxfoundation.org

State Reciprocity Agreements Taxes Tax Foundation Does Wisconsin Tax Income From Other States seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said. 52 rows state taxes can include: wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. All income received by a wisconsin resident is reportable to wisconsin regardless of where it is. Does Wisconsin Tax Income From Other States.

From www.madisontrust.com

What Is the Most Taxed State? Does Wisconsin Tax Income From Other States If you make $70,000 a year living in wisconsin you will be taxed $10,401. the credit for taxes paid to another state is automatically calculated in your account when you add a nonresident return to your. seven states levy no income tax, while some others tax only capital gains, interest and dividends, the foundation said. • the. Does Wisconsin Tax Income From Other States.